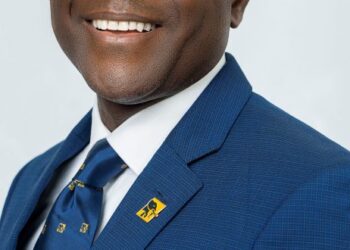

A lawyer, Chuckwuma-Machukwu Ume, SAN, has threatened a lawsuit against Polaris Bank for allegedly withholding a loan facility of N868 million belonging to a customer, Kenchez Nigeria Limited.

Ume, a former Attorney-General of Imo, in a letter addressed to the managing director of the bank, also demanded another refund of N16, 206,860.66 to the company.

He said the N16, 206,860.66 represented the first month’s interest which his client had already paid to Lecon Finance Company Limited, on the loan facility allegedly now being withheld by Polaris Bank.

The lawyer threatened to report the bank to the Central Bank of Nigeria (CBN) and National Deposit Insurance Company (NDIC), including other relevant

regulators, for alleged financial misconduct.

The latter, dated Sept. 15, was received by the bank on Sept. 17 and its certified true copy made available to newsmen on Thursday in Abuja.

The lawyer, in the letter, explained that Kenchez Nigeria Limited, which has been banking with Polaris Bank limited for 22 years, had applied and obtained the loan from Lecon Finance Company Limited to acquire a 160-ton Terex Demag AC160-2 Crane for it’s operational activities.

He alleged after the loan facility of N868 million was paid to Polaris Bank, which acted as the guarantee bank for the loan.

He also alleged that the bank refused to release same to its owner, Kenchez Nigeria Limited, even after satisfying all the preconditions put in place by the bank, including perfecting a legal mortgage over its property in Port Harcourt.

“This is after several demand letters by the company requesting for the utilisation of the guaranteed funds or a refund of same to Lecon Finance Company Limited have not been acted upon by the bank.”

Ume stressed that by holding unto funds earmarked for a defined purpose, the bank had acted contrary to Section 13 of the Banks and other Financial Institutions Act (BOFIA) 2020, mandating banks to conduct their operations in accordance with sound banking practices.

He said the action of the bank was “in breach of the CBN Consumer Protection Regulations, 2019, which requires fairness, transparency, and good faith in dealings with customers.”

He said that the bank had violated both Section 7 of the Money Laundering Act and Section 34 of the EFCC Act, as it cannot unilaterally freeze his client’s account or prevent it access to its account outside the rule of law.(NAN)(www.nannews.ng)

A lawyer, Chuckwuma-Machukwu Ume, SAN, has threatened a lawsuit against Polaris Bank for allegedly withholding a loan facility of N868 million belonging to a customer, Kenchez Nigeria Limited.

Ume, a former Attorney-General of Imo, in a letter addressed to the managing director of the bank, also demanded another refund of N16, 206,860.66 to the company.

He said the N16, 206,860.66 represented the first month’s interest which his client had already paid to Lecon Finance Company Limited, on the loan facility allegedly now being withheld by Polaris Bank.

The lawyer threatened to report the bank to the Central Bank of Nigeria (CBN) and National Deposit Insurance Company (NDIC), including other relevant

regulators, for alleged financial misconduct.

The latter, dated Sept. 15, was received by the bank on Sept. 17 and its certified true copy made available to newsmen on Thursday in Abuja.

The lawyer, in the letter, explained that Kenchez Nigeria Limited, which has been banking with Polaris Bank limited for 22 years, had applied and obtained the loan from Lecon Finance Company Limited to acquire a 160-ton Terex Demag AC160-2 Crane for it’s operational activities.

He alleged after the loan facility of N868 million was paid to Polaris Bank, which acted as the guarantee bank for the loan.

He also alleged that the bank refused to release same to its owner, Kenchez Nigeria Limited, even after satisfying all the preconditions put in place by the bank, including perfecting a legal mortgage over its property in Port Harcourt.

“This is after several demand letters by the company requesting for the utilisation of the guaranteed funds or a refund of same to Lecon Finance Company Limited have not been acted upon by the bank.”

Ume stressed that by holding unto funds earmarked for a defined purpose, the bank had acted contrary to Section 13 of the Banks and other Financial Institutions Act (BOFIA) 2020, mandating banks to conduct their operations in accordance with sound banking practices.

He said the action of the bank was “in breach of the CBN Consumer Protection Regulations, 2019, which requires fairness, transparency, and good faith in dealings with customers.”

He said that the bank had violated both Section 7 of the Money Laundering Act and Section 34 of the EFCC Act, as it cannot unilaterally freeze his client’s account or prevent it access to its account outside the rule of law.(NAN)(www.nannews.ng)

A lawyer, Chuckwuma-Machukwu Ume, SAN, has threatened a lawsuit against Polaris Bank for allegedly withholding a loan facility of N868 million belonging to a customer, Kenchez Nigeria Limited.

Ume, a former Attorney-General of Imo, in a letter addressed to the managing director of the bank, also demanded another refund of N16, 206,860.66 to the company.

He said the N16, 206,860.66 represented the first month’s interest which his client had already paid to Lecon Finance Company Limited, on the loan facility allegedly now being withheld by Polaris Bank.

The lawyer threatened to report the bank to the Central Bank of Nigeria (CBN) and National Deposit Insurance Company (NDIC), including other relevant

regulators, for alleged financial misconduct.

The latter, dated Sept. 15, was received by the bank on Sept. 17 and its certified true copy made available to newsmen on Thursday in Abuja.

The lawyer, in the letter, explained that Kenchez Nigeria Limited, which has been banking with Polaris Bank limited for 22 years, had applied and obtained the loan from Lecon Finance Company Limited to acquire a 160-ton Terex Demag AC160-2 Crane for it’s operational activities.

He alleged after the loan facility of N868 million was paid to Polaris Bank, which acted as the guarantee bank for the loan.

He also alleged that the bank refused to release same to its owner, Kenchez Nigeria Limited, even after satisfying all the preconditions put in place by the bank, including perfecting a legal mortgage over its property in Port Harcourt.

“This is after several demand letters by the company requesting for the utilisation of the guaranteed funds or a refund of same to Lecon Finance Company Limited have not been acted upon by the bank.”

Ume stressed that by holding unto funds earmarked for a defined purpose, the bank had acted contrary to Section 13 of the Banks and other Financial Institutions Act (BOFIA) 2020, mandating banks to conduct their operations in accordance with sound banking practices.

He said the action of the bank was “in breach of the CBN Consumer Protection Regulations, 2019, which requires fairness, transparency, and good faith in dealings with customers.”

He said that the bank had violated both Section 7 of the Money Laundering Act and Section 34 of the EFCC Act, as it cannot unilaterally freeze his client’s account or prevent it access to its account outside the rule of law.(NAN)(www.nannews.ng)

A lawyer, Chuckwuma-Machukwu Ume, SAN, has threatened a lawsuit against Polaris Bank for allegedly withholding a loan facility of N868 million belonging to a customer, Kenchez Nigeria Limited.

Ume, a former Attorney-General of Imo, in a letter addressed to the managing director of the bank, also demanded another refund of N16, 206,860.66 to the company.

He said the N16, 206,860.66 represented the first month’s interest which his client had already paid to Lecon Finance Company Limited, on the loan facility allegedly now being withheld by Polaris Bank.

The lawyer threatened to report the bank to the Central Bank of Nigeria (CBN) and National Deposit Insurance Company (NDIC), including other relevant

regulators, for alleged financial misconduct.

The latter, dated Sept. 15, was received by the bank on Sept. 17 and its certified true copy made available to newsmen on Thursday in Abuja.

The lawyer, in the letter, explained that Kenchez Nigeria Limited, which has been banking with Polaris Bank limited for 22 years, had applied and obtained the loan from Lecon Finance Company Limited to acquire a 160-ton Terex Demag AC160-2 Crane for it’s operational activities.

He alleged after the loan facility of N868 million was paid to Polaris Bank, which acted as the guarantee bank for the loan.

He also alleged that the bank refused to release same to its owner, Kenchez Nigeria Limited, even after satisfying all the preconditions put in place by the bank, including perfecting a legal mortgage over its property in Port Harcourt.

“This is after several demand letters by the company requesting for the utilisation of the guaranteed funds or a refund of same to Lecon Finance Company Limited have not been acted upon by the bank.”

Ume stressed that by holding unto funds earmarked for a defined purpose, the bank had acted contrary to Section 13 of the Banks and other Financial Institutions Act (BOFIA) 2020, mandating banks to conduct their operations in accordance with sound banking practices.

He said the action of the bank was “in breach of the CBN Consumer Protection Regulations, 2019, which requires fairness, transparency, and good faith in dealings with customers.”

He said that the bank had violated both Section 7 of the Money Laundering Act and Section 34 of the EFCC Act, as it cannot unilaterally freeze his client’s account or prevent it access to its account outside the rule of law.(NAN)(www.nannews.ng)